China’s Diamond Industry: A Deep Dive into the Current Landscape

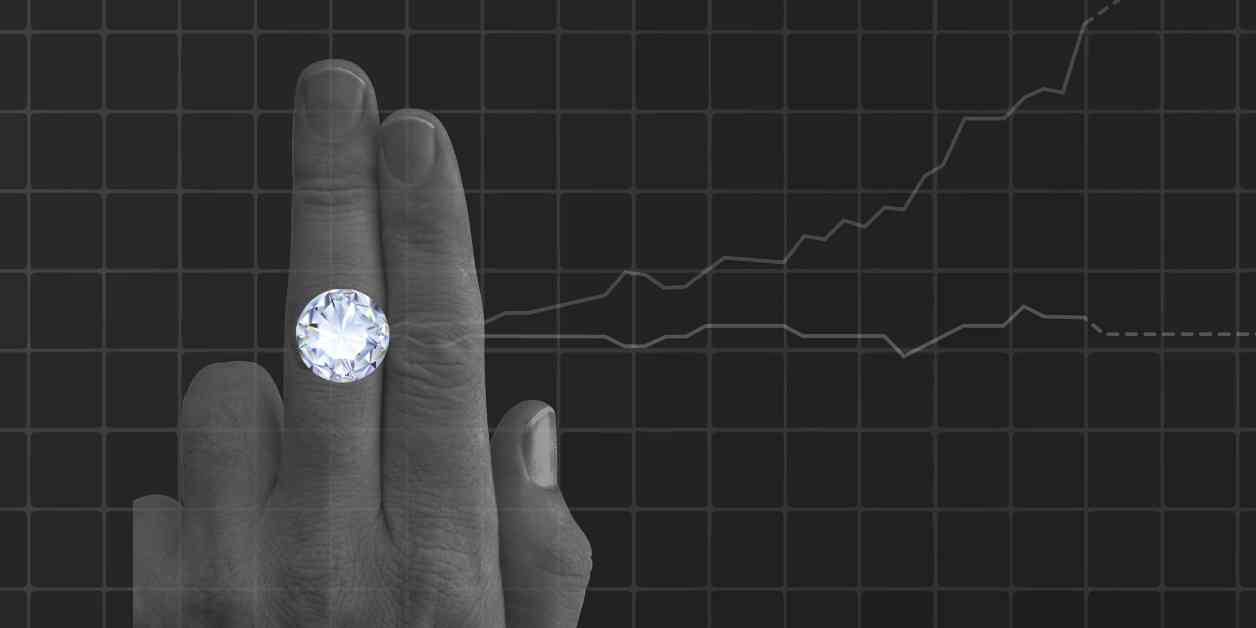

A decade ago, the jewelry industry was abuzz with the promise of synthetic, lab-grown diamonds as the future of the market. As demand for these artificial gems grew, world-leading diamond companies like De Beers quickly capitalized on the trend by launching jewelry lines featuring lab-grown diamonds, marketing them as a more affordable option for younger, budget-conscious consumers. However, market dynamics are ever-changing, and what was once a booming sector is now facing challenges.

In a surprising move this June, De Beers announced its decision to exit the lab-grown diamond jewelry business. The driving factor behind this decision was not a decline in demand but rather the influx of cheap synthetic diamonds flooding the market, which subsequently impacted the company’s profitability. Many of these low-cost diamonds are originating from factories in Asia, particularly from China, where new technologies have spurred a surge in synthetic diamond production. With prices plummeting, companies in the industry are left questioning the future trajectory of the market.

The Rise of China in the Global Diamond Trade

China has emerged as a significant player in the global diamond trade, particularly in the synthetic diamond sector. The central region of China, known as the nexus of the country’s diamond industry, has witnessed a rapid expansion in synthetic diamond production fueled by technological advancements. As a result, the market has become saturated with inexpensive synthetic diamonds, causing a shift in the competitive landscape.

The Impact of the Pandemic on the Diamond Trade

The global diamond trade experienced a tumultuous period during the pandemic. Initially, with people confined to their homes, the luxury and jewelry industries saw a surge in online sales, driving diamond prices to unprecedented highs in early 2022. However, this trend was short-lived, as concerns about inflation and the overheating of the global economy led to central banks, including the United States Federal Reserve, raising interest rates. This sudden shift to tighter financial conditions had a substantial impact on consumer behavior, prompting a reduction in non-essential spending, including on diamonds.

Notably, lab-grown diamonds have bucked this trend, with demand continuing to rise in recent years. The International Gem Society estimates that lab-grown diamonds cost between 40% and 50% less than their natural counterparts, making them an attractive option for price-conscious consumers. Furthermore, the cost of synthetic diamonds has significantly decreased over the years, with prices now a fraction of what they were in the past. This affordability has positioned lab-grown diamonds as a viable alternative to natural diamonds for many buyers.

The Evolution of China’s Diamond Industry

China’s journey in the diamond industry dates back to 1963 when the country created its first lab-grown diamond at a research institution in Beijing. Over the years, the industry has seen significant growth, particularly in regions like Zhecheng in the central Chinese province of Henan. Once a rural agricultural area, Zhecheng has transformed into the “Diamond Capital of China,” boasting a robust ecosystem of diamond processing enterprises.

The emphasis in China’s diamond industry has been on producing diamonds quickly and cost-effectively. The two primary methods used in synthetic diamond production are the high-temperature high-pressure process (HTHP) and the chemical vapor deposition process (CVD). While the HTHP method is favored by Chinese diamond growers for its efficiency and affordability, the CVD process, preferred by Indian producers, yields higher purity stones.

Challenges of Overcapacity in the Diamond Market

Despite the rapid growth of China’s synthetic diamond industry, the market has become oversaturated with an influx of domestic and international manufacturers. This oversupply has led to a decline in jewelers’ revenues, with companies like Signet Jewelers Limited and Chinese market leaders North Industries Group Red Arrow, Henan Huanghe Whirlwind, and Henan Province Liliang Diamond reporting significant revenue declines. With falling prices and excess supply, many firms are shifting their focus to industrial diamonds to remain competitive.

The Future of China’s Diamond Industry

In response to market challenges, companies like De Beers and Henan Huanghe Whirlwind are exploring new opportunities in industrial diamond production. By pivoting towards industrial uses such as semiconductors and solar applications, these companies aim to leverage their expertise in synthetic diamond manufacturing to tap into emerging industries. This strategic shift reflects the adaptability and resilience of the Chinese diamond industry in navigating changing market dynamics.

In conclusion, China’s diamond industry has undergone significant transformations in recent years, fueled by technological advancements and evolving consumer preferences. While challenges such as overcapacity and price fluctuations persist, companies in the sector are exploring innovative solutions to sustain growth and remain competitive in the global market. As the industry continues to evolve, China’s role in shaping the future of the diamond trade is poised to expand, reinforcing its position as a key player in the global jewelry industry.