China’s Housing Pension Plans: Addressing Public Concerns and Ensuring Safety Standards

As China grapples with the challenges posed by an aging housing stock, the government is rolling out new “housing pension” schemes to address the maintenance needs of residential buildings across the country. With nearly 20% of the housing stock over 30 years old and projections indicating that this figure could rise to 80% by 2040, ensuring the safety and structural integrity of these aging structures has become a top priority.

The Urgency of Housing Maintenance in China

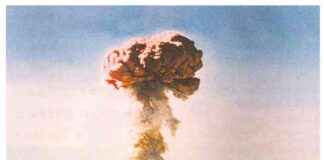

The collapse of an apartment building in the central city of Changsha in April 2022, which tragically resulted in 54 deaths, underscored the pressing need for comprehensive inspections and repairs of older residential complexes. This incident served as a wake-up call for authorities to reevaluate existing maintenance measures and explore new strategies to safeguard the well-being of residents living in aging buildings.

In response to these concerns, the Chinese government has proposed the implementation of housing pension systems to supplement the existing housing maintenance fund. This initiative aims to provide a sustainable source of funding for ongoing inspections, repairs, and renovations, ensuring that residential buildings remain safe and habitable for their occupants.

The Role of Housing Pension Systems in Ensuring Safety Standards

The housing pension system, which is currently being piloted in more than 20 Chinese cities, will be financed through a combination of government contributions and payments from homeowners. By establishing both personal and public accounts, the government aims to create a long-term mechanism for managing the safety of buildings and ensuring that essential facilities such as heating and fire safety are up to standard.

The personal account will consist of capital contributed by individual homeowners, while public accounts will be funded through revenue from state-owned land sales, government subsidies, and real estate-related taxes. This dual-account system is designed to distribute the financial burden of maintenance and renovation projects more equitably, alleviating concerns about potential spikes in costs for homeowners.

Addressing Public Concerns and Misconceptions

Despite efforts to clarify the objectives and funding mechanisms of the housing pension system, some members of the public remain skeptical about the potential impact on their finances. Questions have been raised about how local governments will generate funds for public accounts and whether homeowners will be required to make additional payments beyond their initial contributions to the personal account.

In response to these concerns, government officials have emphasized that the primary goal of the housing pension system is to establish public accounts that will supplement existing maintenance funds, rather than placing additional financial burdens on individual homeowners. By leveraging a combination of government resources and contributions from homeowners, the government aims to create a sustainable funding model that can support the long-term maintenance needs of residential buildings.

Lessons from Pilot Programs and Future Implementation

The pilot scheme introduced by the city of Ningbo in 2023 offers valuable insights into how the new housing pension systems may operate in practice. Under this trial program, homeowners are required to top up their personal housing pension accounts if the initial balance falls below a certain threshold, ensuring that sufficient funds are available for maintenance and renovation projects.

Looking ahead, local governments are likely to establish unified public accounts at the district or city level to streamline the administration of housing pension schemes. This centralized approach will enable more efficient allocation of resources and ensure that funds are distributed equitably across different communities, avoiding disparities in maintenance standards and financial burdens.

Challenges and Opportunities in Implementing Housing Pension Systems

While the introduction of housing pension systems represents a positive step towards addressing the maintenance needs of China’s aging housing stock, several challenges must be overcome to ensure the success and sustainability of these initiatives. One key challenge is the need to strike a balance between government funding and homeowner contributions, ensuring that the financial burden is shared fairly and transparently.

Additionally, the effective management of public accounts and the allocation of funds for maintenance and renovation projects will be crucial in maintaining safety standards and preserving the quality of residential buildings. By implementing robust monitoring and oversight mechanisms, local authorities can ensure that funds are used efficiently and effectively to address the most pressing maintenance needs.

The Future of Housing Pension Systems in China

As China continues to urbanize and modernize its housing infrastructure, the implementation of housing pension systems will play a vital role in ensuring the long-term sustainability and safety of residential buildings. By establishing a stable source of funding for maintenance and renovation projects, these systems will help mitigate the risks associated with aging structures and provide residents with a safe and comfortable living environment.

Through ongoing collaboration between government agencies, homeowners, and community stakeholders, China can build a more resilient and sustainable housing sector that meets the needs of its growing population. By prioritizing safety, transparency, and accountability in the management of housing pension systems, China can set a precedent for effective urban governance and ensure the well-being of its citizens for generations to come.

![EuroDreams (FDJ) Result: Draw of Thursday, November 28, 2024 [Online] news-29112024-173727](https://shanghainewstv.com/wp-content/uploads/2024/11/news-29112024-173727-218x150.jpg)